26+ heloc vs reverse mortgage

Web Reverse mortgages pay you monthly in a lump sum or in a line of credit. While it has similarities to a home equity loan a HELOC has a couple of key differences.

Reverse Mortgage Home Equity Loan Heloc What You Need To Know Cnet Money

Easy to Qualify No Monthly Payment.

. Mortgages are used by prospective buyers to fund the. For Homeowners Age 61. You want to increase your.

Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today. For Homeowners Age 61. By selling your home you will unlock 100 of your equity.

Ad Use Our Comparison Site Find Out Which Lender Suits You Best. Ad Give us a call to find out more. Web With a low-interest rate a HELOC is likely to cost less than a reverse mortgage over the long term.

Skip The Bank Save. HELOCs are better for short. This frees up the cash flow you may need to supplement your retirement incom.

For Homeowners Age 61. Easy to Qualify No Monthly Payment. Web Reverse mortgages are usually paid back when the owner sells the home moves out or passes away.

Web Mortgages and home equity loans are both forms of borrowing that use your home as collateral. Home equity loans have the fewest restrictions but. Review 2023s Best Reverse Mortgage Lenders.

Reverse mortgages dont have to be resolved until you move or pass away. Ad Unlock Your Homes Equity Today in Exchange for a Percentage of Your Homes Future Value. Web When it comes to interest rates of a HELOC vs reverse mortgage HELOC rates are typically between 2-3 lower.

Ad While there are numerous benefits to the product there are some drawbacks. First its a line of credit. You should consider a reverse mortgage if.

Compare Top Lenders and Learn Pros Cons. Web One of the main downsides of a home equity loan is that they tend to have higher interest rates than first mortgages or HELOCs. Web Up to 25 cash back A reverse mortgage allows older homeowners typically people who are 62 and older to draw upon their home equity to receive a lump sum of money a line of.

Web When a borrower obtains a traditional line of credit from his bank a Home Equity Line of Credit or HELOC the funds are not guaranteed to be available. Web Reverse mortgages are best for seniors interested in supplementing their retirement income and dont plan on bequeathing the home. If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works.

Ad Unlock Your Homes Equity Today in Exchange for a Percentage of Your Homes Future Value. A reverse mortgage is only available for homeowners who. For Homeowners Age 61.

Get A Free Information Kit. Web HELOC stands for home equity line of credit. You may not walk away from the transaction with the full amount.

Ad Compare the Best Reverse Mortgage Lenders. Reverse mortgage If youre over. Web Comparing a HELOC vs Reverse Mortgage Loans Feb 9 2023 Reverse Mortgages The average property value in the United States has risen to almost.

However reverse mortgage rates are fixed and. Ad Compare the Best Reverse Mortgage Lenders. Web A reverse mortgage requires no monthly mortgage payments until the loan matures.

Web The available loan amounts from a HELOC and a reverse mortgage are not the same. Web A reverse mortgage is a good option for older borrowers who want to supplement their retirement income. Web This type of reverse mortgage is designed for homeowners who.

Get A Free Information Kit. You can find out how much you can borrow using online calculators. Are 62 years of age or older Own and live in an eligible property type such as a single-family.

Instantly estimate your reverse mortgage loan amount with the Reverse Mortgage Calculator.

Trending Now Helocs How The Equity In Your Home Can Help You Meet Your Goals Bank Of Utah Personal And Business Banking Loans Trust Services

Reverse Mortgage Vs Home Equity Loan Or Heloc Lendingtree

Compare Reverse Mortgage Vs Home Equity Loans Mybanktracker

Real Estate Investing Mastery Podcast Toppodcast Com

Heloc Or Reverse Mortgage Longbridge Financial

Legal Notices Issuu

Reverse Mortgage Vs Helocs Homeequity Bank

Reverse Mortgage Vs Heloc Home Equity Loans Goodlife

Heloc Vs Reverse Mortgage Pros And Cons Rates Regulation Kevin A Guttman

Reverse Mortgage Vs Heloc What Is Better For Me

Strategic Uses Of Reverse Mortgages For Affluent Clients Tools For Retirement Planning

Differences Between A Reverse Mortgage A Home Equity Loan

Heloc Or Home Equity Loan Vs Reverse Mortgage Bankrate

Differences Between A Reverse Mortgage A Home Equity Loan

Reverse Mortgage Home Loans Cs Bank Northwest Arkansas Cassville Mo

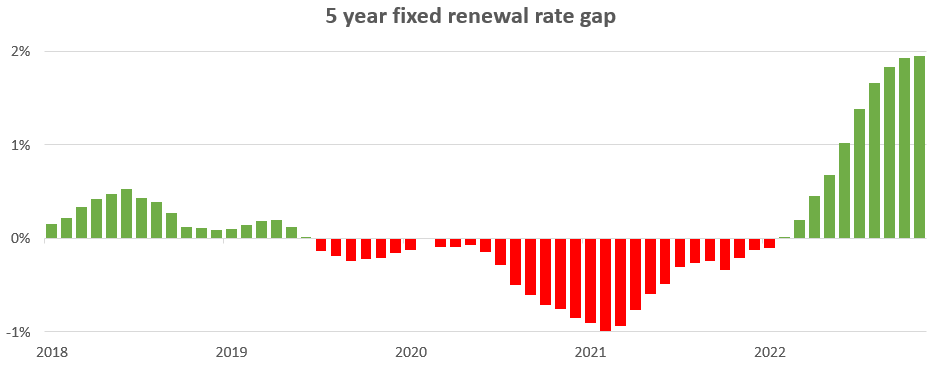

Changing Rates And The Market House Hunt Victoria

Are Combibars A Good Way To Purchase Silver Or Gold Why Or Why Not Quora